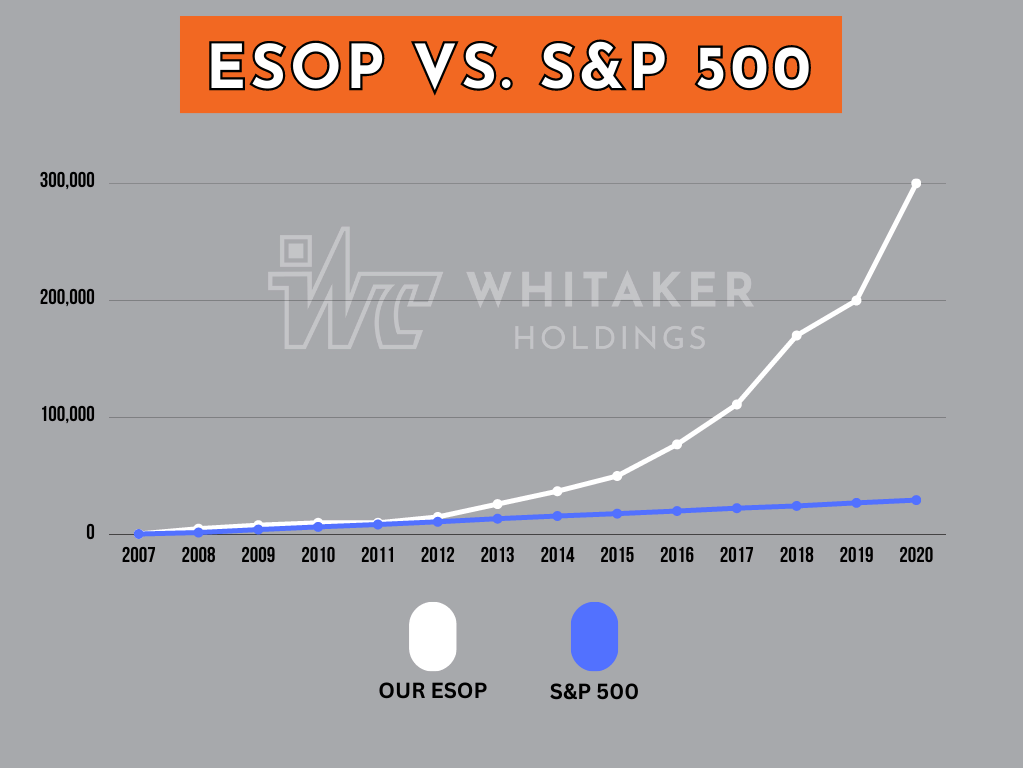

Our ESOP Story

The Whitaker Way

Jim Whitaker, the founder of Whitaker Construction, always wanted his company to be different in the way it treated its employees. He valued the meaning of a team, and he knew that if people are treated fairly and given opportunities to shine, they work harder and have more pride in their work.